New Insights into the Financial Health of the Gaming Industry

Drake Star Partners has released their latest Global Gaming Market report, providing valuable insights into the financial state of the gaming industry.

In our previous coverage of the report, we highlighted the consistent rise in investment and M&A. However, private deals have experienced a slight dip, and the market has yet to reach the same level of growth seen in 2022. In that year, the industry saw 83 deals, with the Zynga acquisition being a significant contributor to their value.

M&A Transactions Chart

Examining the charts on M&A transactions in the past two years, we can observe the peak in Q1 2022 that has sparked speculation about the industry’s future. This peak is primarily attributed to the massive Zynga acquisition.

The anticipated closure of the Activision Blizzard acquisition this year may surpass the previous peak. However, this would once again mean that the peak is heavily influenced by a single company. Other companies still maintain a substantial ratio despite the lower overall value. The decline in deals could be attributed to the saturation caused by the peak of M&A activity, as companies settle in and serial acquirers explore additional options in the meantime.

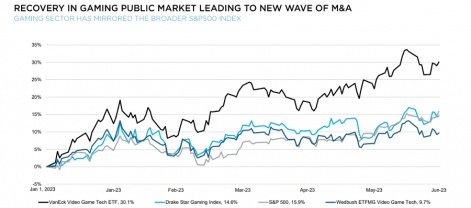

Although the first two months of the year were leaner in terms of deals, March experienced a significant uptick. This rise can be partially attributed to broader economic trends embodied by the S&P 500, which covers more than just the gaming industry.

Considering the specific factors driving the rise in gaming, we must acknowledge the end of the licensing freeze in China and the gradual progress of the Activision Blizzard acquisition.

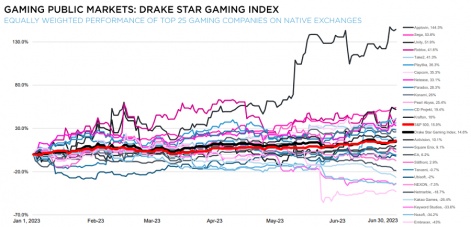

Contrasting Fortunes of Top 25 Gaming Companies

The performance of the top 25 gaming companies offers a striking contrast. Applovin, for instance, experienced a surge in May. On the other hand, Embracer witnessed a steep decline following their poor financials and the collapse of a $2 billion deal in early June. Embracer’s situation may have contributed to the decrease in M&A deals, as their business model heavily relied on constant acquisitions. Other participants might be reconsidering their strategies as a result.

The drop in the Drake Star Gaming Index around this time reflects the adverse impact of Embracer’s downfall, as well as the poor performance of NCSoft and Keywords Studios, both of which saw a decline of over 30%. Ironically, this negative performance stands in contrast to the confidence generated by the expected completion of the Activision Blizzard acquisition. The fate of a major company can dictate both an increase and a decline in the broader market’s performance.

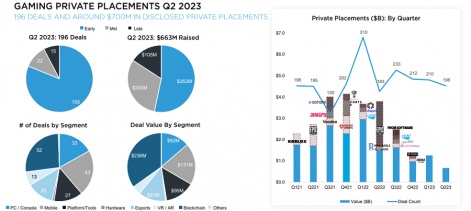

Healthy Private Placements

Private placements have remained relatively healthy. Q4 2021 and Q1 2022 witnessed the highest peak in the last two years, as shown below. Although placements have experienced a decline since this peak, they remain slightly above the levels observed in the comparable quarter of 2021.

In conclusion, while M&A activity has rebounded, it has yet to reach the heights seen in 2022. However, the completion of the Activision Blizzard deal, while potentially inflating the index, will have positive implications for both the gaming industry as a whole and the mobile sector specifically. All eyes are on Microsoft and their expected emphasis on mobile after the acquisition, which will drive further investment into the sector.

Mobile gaming has been leading the way in terms of financial activity, particularly with major acquisitions such as Scopely and Rovio by larger companies that have made headlines beyond the mobile niche.