A Deep Dive into the Mobile Gaming Market in Asia and MENA

A recent report by Niko Partners and AppMagic provides comprehensive insights into the mobile gaming market in the Asia and MENA regions. The report focuses on five key genres – RPG, strategy, MOBA, puzzle, and battle royale – and examines various metrics such as monetisation, engagement, appeal, and esports.

RPG emerged as the dominant genre in terms of revenue, outperforming strategy, MOBA, puzzle, and battle royale genres combined. In fact, East Asian countries played a significant role in RPG’s success, leading to the genre’s highest revenue per download among all genres.

Additionally, RPG topped the engagement ranking among the five genres. However, it fell short in terms of esports due to a lack of competitive elements. Nevertheless, RPG boasted a wider appeal, with a male skew of 61% compared to other genres with a male skew of over 70%. Notably, South Korea witnessed immense success in the RPG genre, accounting for 75% of all mobile gaming revenue, and players in this genre had the highest average income.

Strategic Approaches in the Gaming Landscape

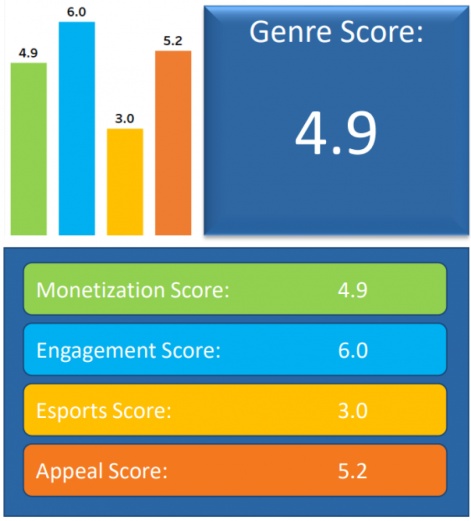

Strategy emerged as the second-largest genre in terms of revenue and the third-largest in terms of downloads. However, it came in fourth place in terms of revenue per download and had the lowest engagement score among all genres, with an average playtime of 5.1 hours per week. Despite this, strategy games had the second highest appeal score, with players being satisfied and open to trying new games within the genre.

Interestingly, while the strategy genre saw declines in The West, it showed strong performance in Asia and MENA in 2022. The report attributes this success to innovation within the genre, which involves combining traditional gameplay with new subgenres to keep players engaged.

Puzzle games emerged as the most downloaded genre, driven by a high number of total downloads and downloads per gamer. Despite spending less time engaging in puzzle titles compared to other genres, puzzle gamers had the second highest average income behind RPG. In terms of demographics, the puzzle genre had the highest average age of players and the second most even gender split. However, puzzle game enthusiasts were the least engaged with esports, showing lower participation in tournaments and online events.

Innovation within the puzzle genre, particularly the introduction of subgenres like merge games, contributed to its success in 2022. Furthermore, fans of puzzle games in Asia and MENA valued localisation, emphasizing the broad appeal of the genre to players who seek games that reflect their own culture.

Emerging Gaming Markets

The Asia and MENA regions are significant players in the gaming industry. While Asia has long been known as one of the world’s biggest gaming markets, the MENA region is experiencing rapid growth in mobile gaming. The accessibility of mobile platforms and the increase in mobile penetration have led to a boom in mobile gaming in Saudi Arabia, the region’s largest gaming market. Saudi Arabia has prioritized mobile gaming and esports in its gaming strategy, evident through key acquisitions and investments in mobile gaming companies like Scopely, Embracer Group, and Nintendo.

Asia, with its diverse market, showcases varying trends across different regions. While Japan has been slower in adopting mobile gaming, Southeast Asia and China have consistently shown a strong preference for gaming on mobile devices. In fact, China is the world’s largest mobile gaming market and is home to major players such as NetEase, Tencent, and MiHoYo.

Note: Several of the companies mentioned in this article were featured in the top 50 mobile game makers of 2022. Stay tuned for our upcoming 2023 list.